Unicaja offers various bonuses and discounts on home, health and funeral insurance, ranging from 3% on funeral insurance and 20% on home insurance to 30% on health insurance. There are also discounts on life insurance and the Uni Insurance Plan, as well as incentives for bringing pension plans.

Unicaja offers various bonuses and discounts on home, health and funeral insurance, ranging from 3% on funeral insurance and 20% on home insurance to 30% on health insurance. There are also discounts on life insurance and the Uni Insurance Plan, as well as incentives for bringing pension plans.

Specifically, when taking out Health Insurance, there is a 30% discount on the rate(1), plus up to three free(2) monthly payments: two for taking out a health insurance policy and an additional one if, together with the health insurance policy, a dental insurance policy is taken out. This promotion is valid until 30 April.

On the other hand, when taking out Home Protection Insurance, it is possible to obtain a 20% discount until 15 April(3), both at branches and in Digital Banking. The promotion applies to those policies with a minimum total annual premium of 250 euros and which insure the building and contents of the home.

Likewise, until 31 March, new subscription for the Single Premium Funeral Insurance will receive a 3% bonus on the net premium.

Wide and varied range of insurances and pensión plans

These promotions are in addition to the wide and varied range of different types of insurance and pension plans that Unicaja makes available to its customers, which include extensive coverage and are adapted to their needs.

In the case of life insurance, Unicaja applies a discount when taking out free life insurance policies for all those customers who have their salary paid directly into the bank. The discount is 10% on the net premium for the first year, for salaries of 2,000 euros or more directly paid into their account, and 5% for salaries of less than 2,000 euros(4).

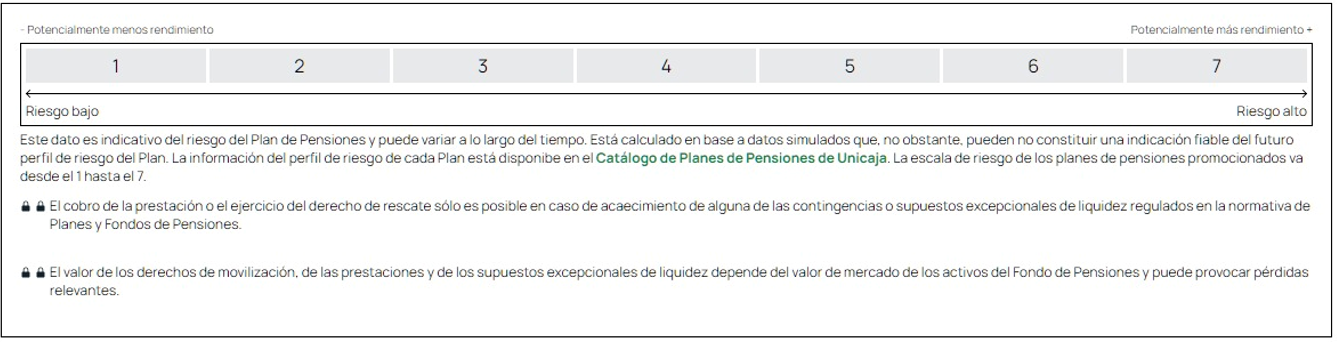

With respect to pension plans, the bank continues to offer bonuses for pension plans by offering the following incentives(5): cash bonus of 2% on the balance transferred (amount transferred higher than 5,000 euros and with six years of permanence) and 3% and 4% (with a contribution of more than 15,000 euros and a permanence of seven and eight years, respectively).

On the other hand, the bank offers discounts on new financed subscriptions of the Uni Insurance Plan(6), a product that allows grouping the customer’s insurance premiums, financing them and dividing them into comfortable monthly installments.

The discounts range from 6% on the net premium of home, health, dental, commercial and auto insurance marketed by Caser, to 10% on free life and accident insurance marketed through Unicorp Vida, a company 50% owned by Santalucía and Unicaja.

In addition, the version of this product aimed at companies and freelancers has recently been launched, the Uni Insurance Plan Companies and the Agricultural Sector(7), which allows to group the premiums, split them and financing without a minimum number of policies.

Insurance contracted with Unicorp Vida (accidents or life risk), Caser (auto, health, dental, multi-risk home, payment protection, pets, hunters, all-risk rental, deaths or accidents), Santa Lucía (deaths) and/or Unión Duero Vida (life risk) and mediated through Unimediación S.L.U., linked banking-insurance operator, registered in the Special Administrative Registry of Insurance Distributors of the General Directorate of Insurance and Pension Funds with registration number OV-0010, acting under through the Unicaja Banco, S.A. network. Arranged civil liability insurance in accordance with current legislation. You can consult the insurance companies with which Unimediación S.L.U. has an agency contract signed at www.unicajabanco.es/seguros. Insurance coverage subject to the General and Particular Conditions of the policies contracted.

The documents with the fundamental data for the participant of all the pension plans are available for download and consultation in the Pension Plan Catalog, the Promoting Entities being: Unicorp Vida, Cía. de Seguros y Reaseguros, S.A./Unicaja Banco, S.A. and Unión del Duero Life Insurance Company, S.A. Managers: Unicorp Vida, Cía. de Seguros y Reaseguros, S.A. and Unión del Duero Life Insurance Company, S.A. Depositary: CECABANK, S.A. Marketer: Unimediación S.L.U. through the Unicaja Banco, S.A. network.

(1) 30% discount on the 2024 pvp rate, already applied to budgets since 09/15/2023.

(2) Promotion valid for new hires from Caser Salud Prestigio, Integral, Activa, Adapta + Esencial Smile, Medical and Start from 03/15/2024 to 04/30/2024, with a maximum effective date of 05/01/2024, which have not been health insured in Caser in the 6 months prior to hiring. Gift of two monthly payments when choosing monthly payment, as long as the premium payment is up to date, in June 2024 and June 2025. In addition, if dental insurance is contracted simultaneously for each health care insured, A third free monthly payment is offered in November 2024. For the Caser Salud Adapta + Sonrisa Esencial product, a gift of three monthly payments when choosing monthly payment, as long as the premium payment is up to date, June 2024, June 2025 and June 2026.

(3) 20% bonus on the net premium of the first year in the annual renewable form of Home Protection Insurance, applicable by credit into account. Promotion valid for new Home Protection insurance policies contracted until April 15, 2024, with a minimum total annual premium of €250 and insuring the container and contents of the home. Applicable conditions if the policyholder is a natural or legal person with an email and mobile phone informed in the insurance policy. The effective date of the contract may be up to 12 months after the date of signing. Applicable to uninsured households in Caser in the last 6 months. Maximum one bonus per policy and insured home. The deposit into the client's account as a “bonus for contracting home insurance” will be made within the next twenty business days from the effective date reported in the contract, provided that the first receipt has been paid. (regardless of whether it is quarterly, semiannual or annual). For contracts postdated in Digital Banking, the offer is limited to two policies for different homes per policyholder. For telephone contracts, the bonus is applied through a 20% discount on the net premium. For registrations in offices, it is necessary that they be free insurance or associated with mortgages formalized within 6 months, financed by the Uni Seguro Plan(5).

(4) Promotion valid until December 31, 2024.

(5) Promotion valid from 01/02/2024 to 12/31/2024 limited to a total of €250,000 for transfers of pension plans received, not subsidized in previous campaigns, from another marketing entity. Minimum transfer amount €5,000 to obtain a gross bonus consisting of 2% of the transfer with six years of permanence or €15,000 to obtain a gross bonus of 3% of the transfer with seven years of permanence or a bonus of 4% of the transfer with eight years of permanence. Maximum total bonus per client in all cases of €3,000 gross. Offer cannot be combined with other transfer bonuses. The promotion is subject to the conditions established in the permanence document and to personal income tax taxation in accordance with current tax legislation. The bonus is considered a return on capital and is subject to withholding on account in accordance with current tax legislation, this being borne by the client and at the rate in force at the time of payment. In the event of non-compliance with the permanence commitment due to the occurrence of some of the conditions detailed below, the client must reimburse Unicaja the proportional part of the amount received as a bonus corresponding to the period of time between the date of non-compliance and the date of termination of the permanence commitment acquired as a penalty in favor of Unicaja. The conditions referred to in this section are the following: a) That the participant transfers, in whole or in part, the consolidated rights of any of said plans to another Pension Plan not marketed by Unicaja. b) That the participant/beneficiary redeems in the form of capital, totally or partially, the consolidated rights of any of said plans due to any of the contingencies or exceptional liquidity cases provided for in the legislation and in the Plan Regulations.

(6) Credit directed to individual consumers, exclusively for the payment of their insurance premiums. For its contracting and maintenance, it is essential to finance at least two insurance policies, of which at least one of them must be newly contracted. Conditions valid until January 31, 2025. Annual nominal interest rate: 0.00%. APR: 0.000%. Starting from a representative example of a Uni Seguro Plan loan granted of €1,500.00, which has been drawn down in full since the first day of validity of the contract, with a fixed monthly payment method of a regular installment for 12 months , in which the client would pay 12 monthly installments of €125.00, with the total amount owed being €1,500.00. For this example, the existence of new credit provisions in Plan Uni Seguro in this period is not considered, nor any incidents in payments.

(7) Renewable annual, multi-annual or single premium temporary insurance, contracted with Caser (insurance for companies and self-employed persons for the Auto and Fleet, Dental, Fire, Theft, Health, Transportation, Merchandise and Helmets insurance lines; and all insurance in the case of Bonding, Agroinsurance, Machinery or leasing breakdown, Surety, Contingencies, Ten-year damages, Legal defense, Commercial Multi-risk, SME Multi-risk, Pecuniary losses, Civil Liability and All construction risk) and/or Unicorp Vida. (life risk) and mediated through Unimediación S.L.U., a linked banking-insurance operator, registered in the Special Administrative Registry of Insurance Distributors of the General Directorate of Insurance and Pension Funds with registration number OV-0010, acting through the Unicaja Banco, S.A. network Arranged civil liability insurance in accordance with current legislation. You can consult the insurance companies with which Unimediación S.L.U. has an agency contract signed at www.unicajabanco.es/seguros. Insurance coverage subject to the General and Particular Conditions of the policies contracted.

Credit aimed at self-employed workers and companies, exclusively for the payment of their insurance premiums. Conditions valid until January 31, 2025. Annual nominal interest rate: 0.00%. APR: 0.00%. Starting from a representative example of a loan in the Uni Seguro Empresas y Agro Plan granted of €1,500.00, which has been drawn down in full since the first day of validity of the contract, with a fixed monthly payment method of a regular installment for 12 months, in which the client would pay 12 monthly installments of €125.00, with the total amount owed being €1,500.00. For this example, the existence of new credit provisions in the Uni Seguro Empresas y Agro Plan in this period, nor any incidents in payments, is not considered.