Unicaja offers its customers a wide range of non-life insurance, life insurance and pension plans that make up a full protection map with coverage and benefits to meet any need.

Unicaja offers its customers a wide range of non-life insurance, life insurance and pension plans that make up a full protection map with coverage and benefits to meet any need.

Non-life insurance

Within this range of products, it is worth highlighting the Seguro Hogar Protección Yavoiyó, an insurance policy for second homes, marketed within the framework of the agreement that the company has with Caser in non-life insurance. This insurance offers extensive coverage and complementary services, such as the displacement of a professional in the event of a claim, so that the customer does not have to move, with a free key collection and delivery service, a home inspection or cleaning service and legal claim in the event of illegal occupation.

Also noteworthy is the improvement of the optional coverage for the elderly A mayores of the home insurance Seguro Hogar Protección, completing the services specifically aimed at the elderly (home help, telephone advice, etc.) with the alert system through the installation of a device in the refrigerator with an opening sensor, which sends a warning if it detects that the appliance has not been opened within a 12-hour interval.

Other Caser insurance policies marketed by the company include:

- Car insurance with Autohelp(1) coverage, with which an accident can be detected automatically, sending the location of the accident to the emergency services, thanks to the installation of a mobile device in the vehicle.

- Pet insurance, with different coverages such as reimbursement of veterinary expenses, telemedicine, veterinary assistance and civil liability.

- Insurance for shops, which, in addition to the usual coverages, offer specific solutions for each activity and an exclusive 24-hour telephone line, staffed by a team of business experts.

- Agricultural insurance, aimed at protecting and guaranteeing the production and facilities of agricultural and livestock farms.

Uni Seguro Plan, life insurance and pensión plans

In order to adjust Unicaja's insurance offer to the needs of its customers, several new features have been introduced in the Uni Seguro Plan(2), a product that allows grouping the customer's insurance premiums(3), financing them and dividing them into convenient monthly installments.

The Uni Seguro Plan provides discounts of up to 10% on the first year's net premium of new policies financed under the plan(4): 10% for Life Free Risk and Accident insurance taken out with Unicorp Vida and a 6% discount on home, health, dental and car insurance (except trailers and tractors) taken out with Caser.

It also includes value services(5) for being a policyholder, such as benefits in access to the Caser Platform, which has special prices on health and wellness services; the Caser dental check, with complete check-ups and discounts on orthodontics and implants, and the Unicorp Vida pharmacogenetics service, with genetic analysis to receive the most effective treatment.

Likewise, access to Caser's loyalty customer program(6) as a Silver Customer when taking out the first policy marketed with Caser, which offers exclusive telephone customer service and a commitment to quality service, is also noteworthy.

In the case of life insurance with Unicorp Vida, Unicaja offers customers a wide range of products adapted to their needs, including specific coverages such as those intended to cover serious illnesses, such as breast and prostate cancer diagnoses, as well as myocardial infarction and cardiovascular accidents.

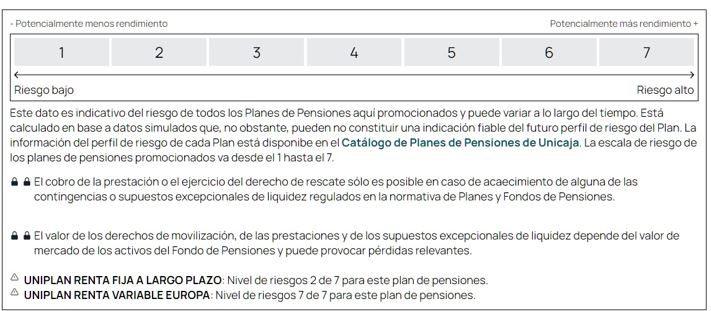

With regard to pension plans, we recommend Uniplan Renta Fija a Largo Plazo (risk 2/7) y Uniplan Renta Variable Europa (risk 7/7) (7).

Insurance contracted with Unicorp Vida (life), Caser (home, car, pets, commercial and agricultural), and mediated through Unimediación S.L.U., a linked banking-insurance operator, registered in the Special Administrative Registry of Insurance Distributors of the Directorate General Insurance and Pension Funds with registration number OV-0010, acting through the network of Unicaja Banco, S.A. Arranged civil liability insurance in accordance with current legislation. You can consult the insurance companies with which Unimediación S.L.U. has an agency contract signed at www.unicajabanco.es/seguros. Insurance coverage subject to the General and Particular Conditions of the policies contracted.

The documents with the fundamental data for the participant of all the pension plans are available for download and consultation in the Pension Plan Catalog, the Promoting Entities being: Unicorp Vida, Cía. de Seguros y Reaseguros, S.A./Unicaja Banco, S.A. and Unión del Duero Life Insurance Company, S.A. Managers: Unicorp Vida, Cía. de Seguros y Reaseguros, S.A. and Unión del Duero Life Insurance Company, S.A. Depository: CECABANK, S.A. Marketer: Unimediación S.L.U. through the Unicaja Banco, S.A. network. Uniplan Long-Term Fixed Income and Uniplan Variable Income Europe are pension plans promoted by Unicorp Vida, Cía. de Seguros y Reaseguros, S.A. and managed by Unicorp Vida, Cía. de Seguros y Reaseguros, S.A.

The contracting and benefits of insurance products, pension plans and also the available promotions are subject to current taxation.

(1) If a possible accident is detected, Caser will contact the insured by telephone to find out their status and provide help as quickly as possible if required.

(2) Credit directed to individual consumers, exclusively for the payment of their insurance premiums. Conditions valid until January 31, 2025. Annual nominal interest rate: 0.00%. APR: 0.00%. Starting from a representative example of a Uni Seguro Plan loan granted of €1,500.00, which has been drawn down in full since the first day of validity of the contract, with a fixed monthly payment method of a regular installment for 12 months , in which the client would pay 12 monthly installments of €125.00, with the total amount owed being €1,500.00. For this example, the existence of new credit provisions in the Uni Seguro Plan in this period is not considered, nor any incidents in payments.

(3) Temporary annual renewable, multi-year or single premium insurance, contracted with Unicorp Vida (accidents or life risk), Caser (cars, health, dental, multi-risk home, payment protection, pets, hunters, all-risk rentals, deaths or accidents), Santa Lucía (deaths) and/or Unión Duero Vida (life risk) and mediated through Unimediación S.L.U., a linked banking-insurance operator, registered in the Special Administrative Registry of Insurance Distributors of the General Directorate of Insurance and Pension Funds with registration number OV-0010, acting through the Unicaja Banco, S.A. network. Arranged civil liability insurance in accordance with current legislation. You can consult the insurance companies with which Unimediación S.L.U. has an agency contract signed at www.unicajabanco.es/seguros. Insurance coverage subject to the General and Particular Conditions of the policies contracted.

(4) Discount on the net premium of the first year, for new insurance contracts with 1st effect 2024 financed in the Uni Seguro Plan (excluding car insurance for trailers and tractors).

To enjoy these advantages and discounts, it is enough to have a Uni Seguro Plan in force. Not combinable with other available offers, unless indicated in their regulatory bases. Starting in the second year, Caser guarantees that the insurance will be renewed at the best available rate based on the individual risk of each client, as long as it remains funded in the Uni Seguro Plan.

(5) These services and discounts are offered to customers who hold the Uni Seguro Plan, regardless of the number of policies associated with it, as well as the branch to which they belong. Not cumulative with another discount or additional promotion, unless expressly indicated in the promotion bases. Access to the Caser Platform+Benefits and Caser Dental Check available until December 31, 2024. Limited to one use per member of the plan holder's family (spouse and children). Access to the 2024 Loyalty Program as a Silver Customer from the first Caser policy contracted by the holder of a Uni Seguro Plan. All clients who are already part of the Platinum and Gold Loyalty Program remain in their corresponding program. The pharmacogenetics service is not an insurance contract, but rather a separate service that Unicorp

(6) Caser 2024 loyalty program available for policyholders with one or more insurance and one claim per policy per year. It includes discounts of 6% to 10% for new hires with 1st effect 2024, with commitments to quality of care and bonuses for non-compliance with commitments.

(7) Past returns do not imply future returns.