Unicaja has a new product for its customers to plan their personal savings in a simple and free way: digital piggy banks.

Through this service and with simple savings rules, the customer can set up small automated transfers from a current account held at the bank to his or her digital piggy bank. In this way, planned and sustainable savings are encouraged.

These piggy banks, available to individual customers of legal age, allow customers to customize both their savings goal and the date by which they will achieve it.

Customers can have up to five piggy banks active at the same time, and they can choose or combine several savings rules: periodic contributions, establishing the frequency that best suits their needs; a percentage of their salary, pension or unemployment benefit they want to allocate; the round up of purchases made with a card or even the goals of the selected First or Second Division soccer team, according to the value he establishes for each goal.

In addition, customers have the possibility to make as many extraordinary contributions as they wish, regardless of the established rules, in order to accelerate the achievement of their goal.

With the rules set by the customer, the system calculates daily the money to be transferred from the current account to the piggy bank, and also provides alerts on the progress of savings.

Once the goal is achieved, the customer can 'break' his piggy bank, transferring the money to the linked account and set a new goal to continue saving.

Available on Digital Banking

In order for customers to create a piggy bank for their savings goals, they must have an active current account and be a user of Unicaja's Digital Banking.

Through the latter, you can sign up for a free Piggy Bank Savings Account, which has no fees or commissions.

This new feature is part of Unicaja's digital strategy, which aims to help in the management of its customers' personal finances through simple services accessible to all, including Unicaja Key and the virtual assistant Nica.

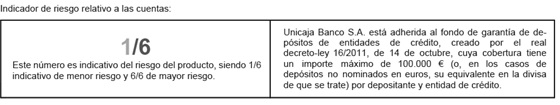

* Cuenta sin comisiones de mantenimiento ni de administración: TIN 0%, TAE 0%. Esta cuenta puede usarse únicamente para traspasos entre cuentas de Unicaja con el mismo titular. No permite tarjetas ni domiciliaciones ni abono de cheques ni descubiertos ni recibos ni cuotas de préstamos ni operativa de ingreso o retirada de efectivo. Una sola cuenta por cliente.